Chairman of the Department of Economics and McCord Professor of Executive Management Development at Bradley University

Chairman of the Department of Economics and McCord Professor of Executive Management Development at Bradley University

Welcome to Peoria Magazine’s Econ Corner, a recurring feature in which we pose questions to experts about various economic issues and how they affect our lives and careers here in central Illinois. This month’s participant is returning contributor Dr. Joshua Lewer, Chairman of the Department of Economics and McCord Professor of Executive Management Development at Bradley University.

Peoria Magazine (PM): There have been some 25 “bear markets” on Wall Street – generally defined as a value downturn of 20% or more – since the Great Depression, and five so far this century between the dotcom crash, 9/11, the Great Recession in 2008, COVID and the current inflationary situation. The Wall Street Journal recently ran a story under the headline, “Don’t Give Up on the Stock Market.” Is investing any riskier than it ever was? Are there reasons to be hopeful regarding a rebound?

Joshua Lewer (JL): Long-term capitalism is a powerful environment for us to earn the rewards of capital markets. I can’t forecast if we have hit bottom or if we will see a much bigger drop in the short run. But what I know for sure about bear markets is one, they all end; and two, recent market declines bode well for higher long-term future returns.

Investing in stocks will always be risky, especially since most underperform the market overall long term. People need to reframe volatility with risk. Volatility is a temporary decline. Risk is a permanent loss to capital and/or not meeting your financial goals. You can mitigate equity risk through broad, low-cost diversification with index and asset class ETFs allowing you to own thousands of stocks.

My friend and fee-only fiduciary in Peoria Heights, Mike Mahoney, always says, “Focus on what you can control, mainly asset allocation, costs and taxes.” A key takeaway for investors is not exposing one’s portfolio to any more risk than they are willing and need to assume to reach all their goals.

PM: The average 30-year mortgage rate has eclipsed 7%, the highest in 14 years, since the subprime mortgage fiasco of 2008. Monthly mortgage costs on an average-priced home, 10% down, in the U.S. are now $1,000 higher than they were in August 2021. As a result, fewer people are buying and selling. What’s the relationship between what’s happening in the housing market and the prospects of sliding into recession with all of its attendant consequences – higher unemployment, etc.?

JL: While there are many potential scenarios the economy could take during this time of quantitative tightening (QT) and rising interest rates, the most likely outcome is recession. I’m sorry to say this, but we have never had a meaningful inflation spike that didn’t end with some pain. At his Aug. 26 Jackson Hole speech, (Federal Reserve Chairman) Jerome Powell plainly stated that “… pain for households and businesses are a price to pay for bringing down inflation.”

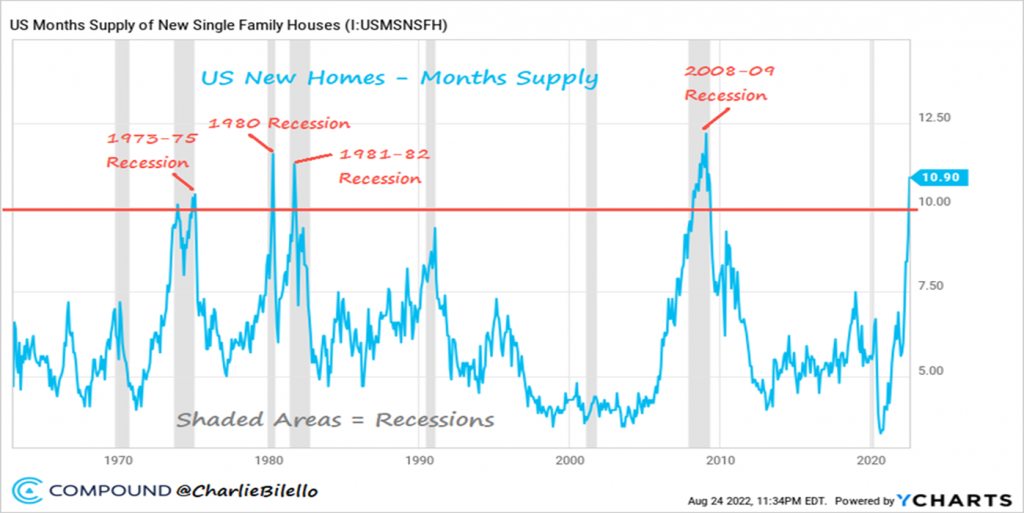

And, yes, housing starts are definitely an important leading economic indicator. They are clearly telling us that a slowdown is coming. As the graph on the right reports, recessions occur when the monthly supply/inventory of new homes tops 10 months. It has been a flawless recession indicator.

PM: Conversely, consumer spending in other sectors – travel, dining, services, etc. — remains up, which could prompt further Federal Reserve action on interest rates. With the Fed trying to restrain an overheated economy, what explains the continued buying?

JL: The answer is multifaceted, but I would focus on the resilient labor market and the fact that fiscal stimulus just keeps flowing.

The major stock market pullback during the first week of October clearly came from the digestion of the strong September jobs report showing that payroll employment grew a healthy 263,000, unemployment fell from 3.7% in August to 3.5%, and wage growth grew at a robust 5%. This reinforces aggregate demand. The September jobs report was not all good, and in fact provided some fairly scary aggregate supply data points that we will have to grapple with going forward. Notably, labor productivity and labor force participation rates declined, both of which could cause prices to rise further.

Also, fiscal stimulus at the state level just doesn’t stop either. Several states including California (i.e. California’s Middle Class Tax Refund program) and Illinois (i.e. Illinois Family Relief Plan) have just sent out another round of checks, most of which will be spent, thereby increasing aggregate demand and inflation.

The Federal Reserve will respond. Their only tool is quantitative tightening. Unfortunately, monetary policy is a blunt tool with significant lags.

PM: Inflation in the Eurozone has topped 10%, the highest recorded since the currency there was created. Some nations are above 20%, and Germany is at its highest rate since 1951. Great Britain’s new prime minister announces tax cuts to stimulate growth there – even in a high inflation climate – and the global reaction is swift and unwelcome. To what degree do we control our own economic destiny in the U.S., or are we at the mercy of the world no matter what we do?

JL: I am very hopeful for the future. We humans are very resilient and resourceful and regardless of what happens, we will always seek to improve our lives and society.

And yes, we are in this thing together. So when one of our neighbors and trade partners halfway across the globe gets sick with inflation, goes to war, and/or falls into recession, we feel it here at home too. There are many positive attributes to globalization, including efficient resource use and comparative advantage, but the downside is that we are now more interconnected. But there is no alternative. It is a historical truism that closed economies are more likely to go to war, have slower economic growth, and have widespread poverty.