Dr. David Cleeton is chairman of the Department of Economics at Illinois State University.

Welcome to Peoria Magazine’s Econ Corner, a recurring feature in which we pose questions to experts about various economic issues and how they affect our lives and careers here in central Illinois. Our guest this month is Dr. David Cleeton, chairman of the Department of Economics at Illinois State University.

Peoria Magazine (PM): There has been a fair amount of scholarship on the economics of education. Much as the bumper sticker “My kid beat up your honor roll student” was popular once upon a time, is there any doubt as to the link between educational attainment and an economic payoff down the road on a variety of fronts? What are some of those economic dividends — in lifetime wages, for example?

David Cleeton (DC): While there are innumerable forms of returns to higher education in terms of knowledge attainment, including better appreciation of literature and the arts, improved social skills, and expertise acquisition conducive for lifelong learning, you have asked me to look at monetary returns when modeling higher education as an investment.

Like any investment, a proper evaluation requires looking at the magnitudes and time distribution of the costs balanced against the benefits of higher future earnings. The decision to attend college postpones employment and incurs net tuition and fees up front and perhaps higher room and board expenditures. The return is usually realized in the form of higher wages and salaries post degree completion, continuing for the remainder of the working life. And, of course, we must factor into the analysis the repaying of net borrowing costs to finance college expenditures.

We know that realized positive investment returns continue to exist for the college graduate in the median position. If we measure the ratio of net income at age 30 of a person attending college to that of a high school graduate of the same age, the ratio is nearly two to one (as of 2018-19) at the median of the distribution.

However, there exists a huge amount of variation around this central tendency. Among the top 10% of earners, the ratio increases by nearly 40%, while among the lowest 10% of earners, the ratio drops by around 25%.

There are also significant disparities across alternative categories of higher education institutions. The data from public institutions over the same period shows the following earnings ratios at the 25th, 50th and 75th percentiles: 1.72, 1.94, and 2.30. From private non-profits, the corresponding figures are 1.75, 2.08, and 2.56. And for private for-profits, we have 1.14, 1.38, and 1.64. Thus, the private non-profits have a higher median but wider spread than the publics. The private for-profits have the lowest median and the narrowest spread, making them the worst choice.

There also are important differences in returns based upon gender and the choice of major. The dynamics across all these categories are also impacted by the general economic cycle. For example, students completing their degrees and entering the labor force during a recession tend to have lingering effects, which lower their investment returns. However, there continues to be strong evidence that student preparedness, measured by test scores and pre-college investments in preparatory skills, has a significant payoff by raising completion rates conditional on attending college.

On average, those honors students will reap higher financial returns from college attendance and graduation.

PM: There are huge inequities in K-12 educational spending across the country, especially in an Illinois that relies so heavily on property taxes to fund public schools. Is there a connection between spending and classroom outcomes, a get-what-you-pay-for component? If so, do government policies that permit such disparities make any sense? Is there a better way?

DC: There is a wide range of K-12 spending per pupil across America, but Illinois is close to the median even with a high level of property tax dependence. Southern states tend to spend less and Northeastern states more. But then, the very sparsely populated states such as Idaho, Wyoming and Alaska also spend far more per pupil than Illinois.

Furthermore, most states have made vast improvements in equalizing funding for school districts. Wealthy districts subsidize poor districts to tightly control the range of resources available per student. Given this effective progressive tax rate system on local districts and variation in household incomes across districts, there has developed an incentive for well-resourced families to supplement educational attainment with out-of-school investments such as special camps and tutoring. This may complement STEM and honors program sorting within public schools. When combined with increasing variability in family structures and incomes, student achievement variability across more equally funded public schools on the surface reveals little casual relationship between expenditures per pupil and achievement measures.

However, we know that students who come from less-resourced families on average enjoy less success in educational achievement. If we don’t substitute public resources for the lack of private resources, these students will continue to underperform and show less preparation for success at the next level. They will have lower high-school graduation rates, lower college-enrollment rates, and lower degree-completion rates.

Better understanding of these links and causal relationships may produce a direction for reform that results in differential reallocation of resources within the current system, focused primarily on equalized funding per student across school districts within a state.

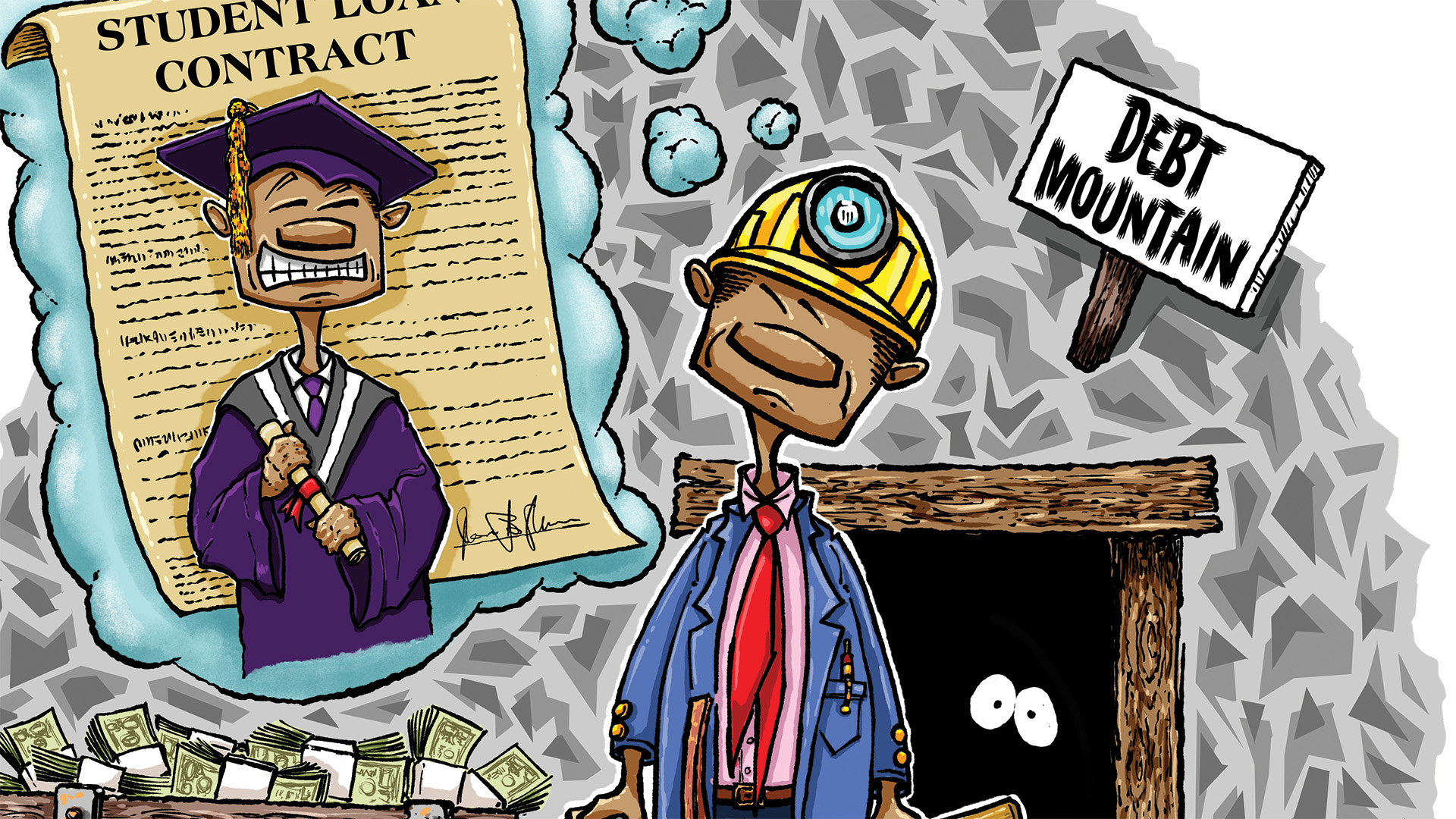

PM: On the higher education front, according to the Education Data Initiative, between 1970 and 2020, average annual tuition and fees at four-year public institutions climbed 2,511%, at private institutions nearly 2,000%. That’s roughly quadruple the rate of inflation over those 50 years. That may explain why student loan debt surpassed credit card debt in the U.S. about five years ago, and why the average college graduate in 1970 left school with $1,070 in debt, compared to $31,000 in 2023, an inflation-adjusted increase of 268%. As a result, more young people are questioning whether college is worth the investment. Is there any way that bodes well for America? It’s a controversial topic, but from a purely economic standpoint, is student loan forgiveness wise or unwise?

DC: There have been significant changes in financing models of higher education over the past half century. State funding for public colleges and universities has shifted toward starkly lower annual funding of operating expenses while maintaining capital budgeting for buildings and grounds. This has forced a shift away from state general tax revenue toward user levies in the form of tuition, fees, and room and board charges.

The ultimate incidence of this transformation has produced a good deal of variability based upon the mix of tax sources (state sales and income taxes) and public grants and scholarship programs for students. In general, the old system tended to greatly disfavor lower-income families who paid sales taxes but were much less likely to send their children to public colleges.

Last time I looked at the price printed on my 8-oz. bag of Lay’s potato chips, I saw $4.19. But at the Kroger checkout counter, they rang up a sale price of $1.99. You should keep in mind that listed tuition rates are MSRPs (manufacturer’s suggested retail prices). Standard practices are to have significant tuition discounting via scholarships, which are both income-related and merit-based. Via these policies, both public and private non-profit colleges now typically have an overall tuition discount rate in excess of 50%.

A college president once told me that the annual cost of private college tuition remains about level with the price of a new, mid-sized Chevrolet. And given the way financing has evolved, the lower taxes reaped from lowered public financing can support paying higher out-of-pocket charges. We can add to that the advantage of qualifying for a subsidized student loan to finance the net cost.

What you don’t want to do is to loan-finance college attendance and choose the wrong major at a private, for-profit college where you fail to complete a degree. That is a recipe for a higher education train wreck!