When Congress passed the Tax Cuts and Jobs Act in 2017, the new Code Section 199A—also known as the 20% pass-thru deduction—was one of the most intriguing changes. In January 2019, just days before the start of the tax filing season, the IRS released the final regulations for this deduction. In case you need a refresher on Section 199A, here are the highlights:

– A 20% deduction is available to individual taxpayers for up to 20 percent of Qualified Business Income. QBI is the net amount of income or loss from any qualified business conducted through sole proprietorships and pass-thru entities (S-corporations, partnerships, trusts and estates).

– The deduction is limited to taxable income less net capital gains.

– Above certain taxable income levels, income from a specified service business (SSB) is not eligible for the deduction—and there may be other limits that will reduce the deduction.

Rental Real Estate

One area that has been a source of uncertainty is how rental activities fit into Section 199A. Previously, we knew that a rental could qualify for the deduction if: 1) It rises to the level of a Section 162 trade or business; or 2) The property is rented to a commonly owned operating business (self-rental).

A small but significant change was made in the final regulations such that the self-rental rule no longer applies to property rented to a commonly owned C-corporation. Property rented to a commonly owned business operated by an individual or pass-thru entity (S-corporations, partnerships and trusts) is still automatically deemed a qualified business for purposes of Section 199A. Common ownership means the same individuals own 50 percent or more of both entities, and the final regulations apply taxpayer-friendly family attribution rules, taking into account any ownership by the taxpayer’s spouse, children, grandchildren, parents, grandparents and siblings.

For property that is not a self-rental, we still lack solid guidance on what factors determine whether it rises to the level of a qualified business. The IRS instead provided a third way that rentals could qualify for the Section 199A deduction by releasing a proposed safe harbor for rental real estate enterprises. Such enterprises can include multiple rental properties, but commercial and residential real estate cannot be combined. To meet the safe harbor, they must meet the following requirements:

- At least 250 hours of rental services must be performed during the year by owners or their employees, agents or independent contractors. The safe harbor provides examples of specific services that do or do not count for the hours test.

- Separate books and records must be maintained for each enterprise. Starting in 2019, contemporaneous records documenting the hours worked must be kept.

- The enterprise must not include triple net leases (in which taxes, maintenance, fees and insurance expenses are all paid by the tenant).

- The enterprise must not include property used as a personal residence for any part of the year.

- A statement specifying that the above requirements have been met, signed by the taxpayer under penalties of perjury, must be attached to the return.

Keep in mind that this is a safe harbor and was not included in the final regulations—meaning that while taxpayers may use the safe harbor until future guidance is provided, it can be changed more easily than a regulation. Also remember that a rental activity may still be considered a qualified business without meeting the safe harbor.

Qualified Property

Taxpayers above certain income levels are subject to limits that may reduce the 20% deduction. In that case, QBI from each business is limited to the greater of 50 percent of wages or 25 percent of wages plus 2.5 percent of qualified property unadjusted basis immediately after acquisition (UBIA). At a basic level, qualified property includes property that is depreciable (not land), held at the end of the tax year, used in the production of QBI, and for which the depreciable period has not ended. Only the owner’s allocated share of wages and UBIA count toward the limit.

There is some question about how to allocate UBIA among owners of partnerships and S-corporations when there are ownership changes. Additional guidance may be coming. What is clear is that owners who sell their ownership interest during the year will not be allocated any UBIA. Other implications of the timing of asset or ownership sales should be discussed with your tax advisor.

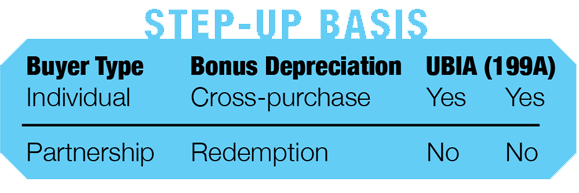

The final regulations did clarify a few technical aspects of what is included in the UBIA of qualified property. We now know that qualified like-kind property received in a Section 1031 like-kind exchange keeps the same UBIA as the relinquished property. This is adjusted if cash or non-like-kind property are included in the exchange. Partners who have Section 743 basis adjustments resulting from a cross-purchase (buyer is an individual) can count the basis adjustment as UBIA to the extent it reflects an increase in the FMV of the underlying qualified property. Alternatively, a Section 734 basis adjustment from a redemption of a partnership interest (buyer is the partnership) would not be considered UBIA. This is the same as bonus depreciation, for which a cross-purchase is eligible for bonus depreciation, but a redemption is not.

Additional Clarifications

For the most part, the list and descriptions of SSBs—business fields specifically excluded from the pass-thru deduction—were left unchanged in the final regulations. One exception was the definition of the field of health, which the proposed regulations defined as services involving the provision of medical services directly to a patient (for example, physicians, pharmacists, nurses, dentist, veterinarians, physical therapists, psychologists). The final regulations made a minor wording change by removing the language “directly to a patient.” This appears to clarify that certain medical professions that may not involve direct services to a patient (such as a radiologist) are still considered SSBs.

Another clarification in the final regulations is that certain deductions made on an individual’s return that are attributable to a qualified business should reduce the Section 199A deduction from that business. These deductions include the deductible portion of self-employment tax, self-employed health insurance deduction and the self-employed retirement deduction.

Summary

While we cannot fully cover the final Section 199A regulations in an article of this size, hopefully this has been a helpful update on a few of the most relevant topics. Now that the first tax filing season with Section 199A fully in play is behind us, it is worth reiterating the importance of keeping an open line of communication with your professional advisers. Ask questions about Section 199A and whether your businesses or rentals will qualify. If your deduction was limited this year, discuss the driving factors and plan now for whether something can be done to increase your deduction next year. As far as we know, the Section 199A pass-thru deduction is only around through 2025. PM

Adam Koch is a senior accountant at Heinold Banwart. He can be reached at (309) 694-4251 or [email protected].