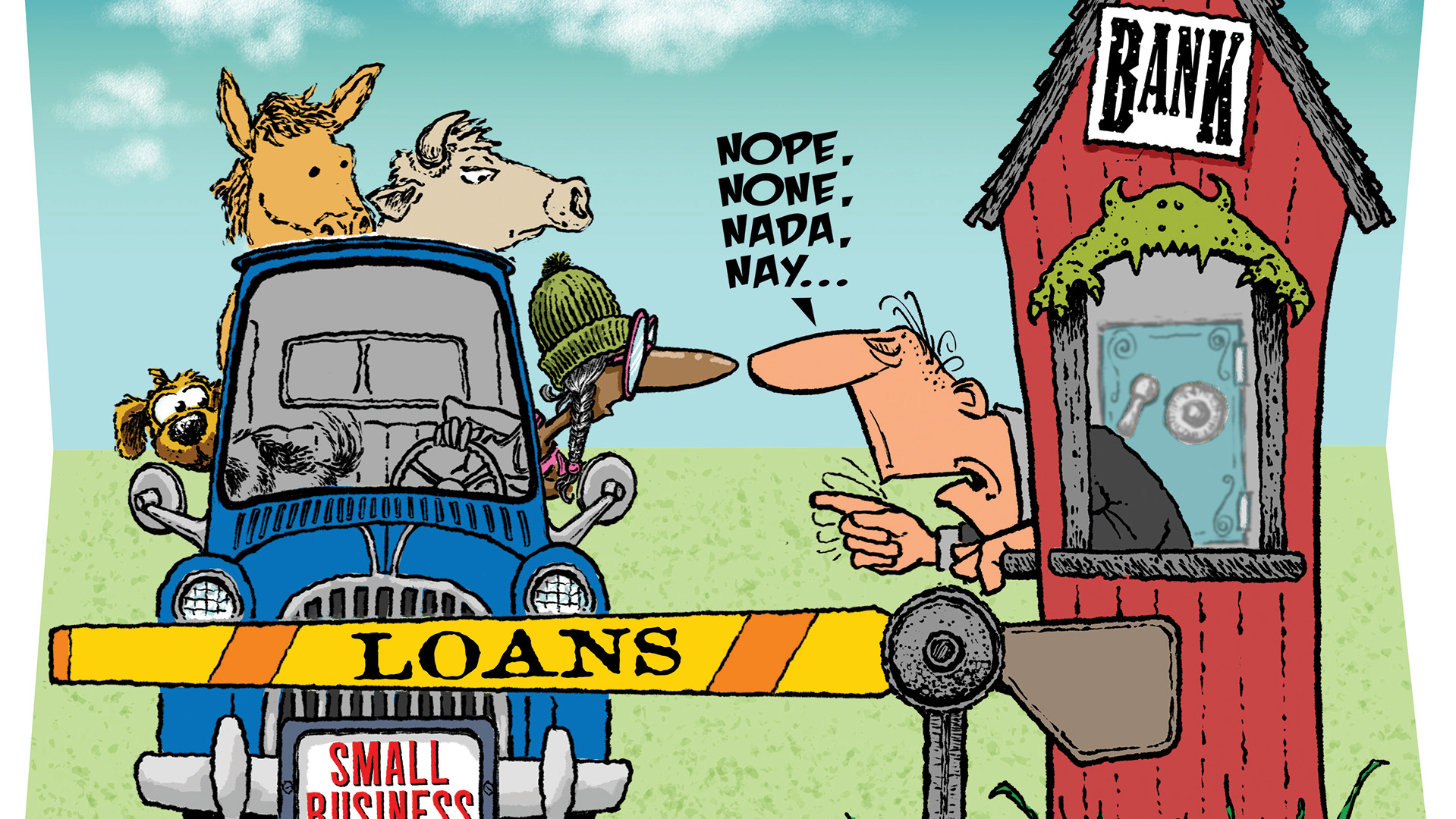

Small businesses are often the backbone of an economy. They not only create jobs but also contribute to the overall growth of a country. However, obtaining financing for a small business can be challenging, especially when traditional bank loans are not an option.

small businesses often face financial barriers when they attempt to access traditional bank loans

Innovative financing has emerged as an alternative to traditional lending options. Those options provide small businesses with the necessary capital to help start or expand. They include:

Crowdfunding

Crowdfunding is a financing option that allows small businesses to seek contributions from a large number of individuals who each invest a small amount of money. This method is often used to finance projects such as product development, marketing campaigns, and research.

Crowdfunding has become more popular over the years and has helped many small businesses get off the ground.

Peer-to-Peer Lending

Peer-to-peer lending is a method that connects borrowers with individual investors. Such lending platforms provide a streamlined process, quicker approval and low-interest rates as compared to traditional banks.

Peer-to-peer lending is an alternative to traditional lending options that are often lengthy and require a high credit score.

Community Development Financial Institutions

CDFIs are financial institutions that are designed to provide affordable credit and financial services to underserved communities. These institutions are usually nonprofit or low-profit organizations that aim to help small businesses that are traditionally excluded from receiving loans from banks.

CDFIs provide services such as loans, technical assistance and training, and are often backed by the government.

Microfinance

Microfinance is a financial service that provides small, short-term loans to individuals or small businesses that do not have access to traditional credit. These loans are often provided by non-governmental organizations (NGOs) and are typically given to people in developing countries or those who live in poverty.

Microfinance has now become popular in developed countries, especially among small businesses that are unable to obtain loans from traditional banks.

Invoice Financing

Invoice financing is a method whereby small businesses use their invoices to obtain short-term financing. This financing option is useful for businesses that have outstanding invoices and need cash to fulfill orders or pay bills.

In invoice financing, the lender advances cash against the unpaid invoices of the borrower, and when the invoices are paid, the lender receives the amount advanced plus a fee.

In conclusion, small businesses often face financial barriers when they attempt to access traditional bank loans. Innovative financing options such as crowdfunding, peer-to-peer lending, community development financial institutions, microfinance and invoice financing are emerging as viable alternatives.

These options provide access to capital, increased flexibility and faster processing time compared to traditional bank loans. They can be the fuel that drives the growth of small businesses in today’s economy.

Dee Brown