Welcome to Peoria Magazine’s Econ Corner, a recurring feature in which we pose questions to experts about various economic issues and how they affect our lives and careers here in central Illinois. This month’s participant is Dr. David Cleeton, Chairman of the Department of Economics at Illinois State University.

Peoria Magazine (PM): Russia invades Ukraine and the price of gasoline tops $4 per gallon at central Illinois gas stations. Everyone accepts that we now live in a global economy, but can you connect the dots for us as to how this conflict so very far away has such a significant ripple effect here in the middle of America, especially since it involves a Russia with an economy smaller than the state of Texas, representing less than 2 percent of global GDP?

Dr. Cleeton: The great expansion of domestic output in the United States in the 21st century has made our country the largest producer of oil and gas in the world, and that has led to an almost total net independence in the sense that net imports — imports less exports — have become very small. Furthermore, Russian products are less than 10 percent of our imports. But oil and gas are produced and traded in a global market in which imbalances in supply and demand can create significant price swings in the short run …

In the short term, the United States does not have enough current capacity to increase output sufficiently to make up for the absence of Russian imports. Only major OPEC+ producers such as Saudi Arabia, the UAE, and on the gas side Qatar would be able to significantly increase production.

So, we will be faced with higher oil and gas prices for some time. In the longer run, higher oil and gas prices will induce more domestic production, which can come online in a year or two and provide some price relief.

We can expect that consumers will react to higher prices by shifting expenditures to alternative modes of transportation, as well as reducing driving. It may lead some consumers to give more consideration to making a purchase of an electric vehicle, which has a positive payoff in terms of climate goals.

In addition, there will be pass-throughs of higher fuel prices across the transportation sectors to raise prices in general for commodities and services, which make use of trucking, rail and air services. Competitive forces and demand factors will limit the degree to which the full cost increases can be passed forward.

PM: The United States and its allies have leveled some of the harshest economic sanctions against Russia since the Cold War. What’s your opinion of sanctions in general as a foreign policy tool? Are or can they be effective in influencing behavior? Do they punish the intended targets or are they more likely to produce unintended victims, including back here in the U.S.?

Dr. Cleeton: There is a long history of using economic sanctions, including import restrictions and higher tariffs, as policy levers. Given that trade is typically arranged because it is a good bargain for both sides, it should be clear that interfering in trade imposes losses to both parties in the transaction. So, the effectiveness of sanctions should be looked at in a benefit-cost framework.

We have many examples of the failure of sanctions to influence and change behavior when the sanctioned parties appear to be willing to bear the costs. Take our longstanding sanctions against Venezuela, North Korea and Cuba as examples. In this century, the United States has ratcheted up the use of economic sanctions and we currently have more than 10,000 countries, organizations, companies and individuals on the list.

How the benefits and costs break out depend as well on the volume of trade and transactions involved. Western European countries, with the exception of North Sea production by Norway and Britain, are not significant producers of oil and gas. That means they are dependent on imports, and Russia is their main supplier. Limited availability of short-run alternative supplies, particularly in natural gas, means that the costs of banning those Russian supplies is too high for them. The European Union has taken the alternative policy of a longer-run solution of targeting a two-thirds reduction through alternative suppliers going forward.

However, the current situation with Russia clearly stands out as the most wide-ranging and comprehensive set of financial and economic sanctions implemented on an advanced economy. We will see how the impacts evolve and, just as importantly, if the policy works, how it will be unwound. Once you undertake a strategy, the opponent will respond and you must be willing to work going forward with an adaptable plan that hopefully has a resolution.

The disputes with Iran over the past four decades have demonstrated many twists and turns, and the nuclear control treaty, which we ourselves abrogated, is now being renegotiated. However, that is being held up with Russia as a signatory holding out for a clause to allow unrestricted trade with Iran, perhaps to funnel oil to the global market.

PM: What other sectors besides energy do you expect to be hardest hit if the war and the sanctions drag on, and how soon before consumers here start to notice the difference? The food and auto industries reportedly may be up next, and perhaps other products due to further disruption to the global supply chain.

Dr. Cleeton: We should be aware that Ukraine and Russia are very significant exporters of wheat and other grains, which are shipped via the Black Sea. The supply chain bottleneck will be severe for an extended period of time, and crop production and yields are also likely to be significantly impacted, resulting in substantial price increases in these commodity markets.

Russia is also a major exporter of a number of rare metals – nickel, for example. There have been very rapid price increases in the global markets for those metals, but once again the supply responsiveness in the short run is very limited, so those costs will be passed forward.

The key issue is what proportion of a product’s total cost is associated with these more expensive inputs, and what if any hedging have the producers taken via futures markets to limit their price exposure.

Airlines in general have approximately 35 percent of their operating costs composed of fuel expenses, but the range of hedging to control that exposure varies from 60 percent to 0 percent across the industry. That will lead to very different impacts in profitability for the carriers, who are operating in an environment where they are battling back from a huge drop in demand from the COVID crisis and will be reluctant to fully pass forward the higher costs.

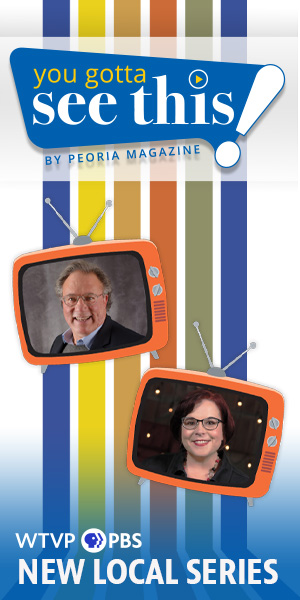

Dr. David Cleeton, Chairman of the

Department of Economics

at Illinois State University