Dr. Charles Kahn

Professor emeritus of finance at the Gies College of Business,University of Illinois Urbana-Champaign

Welcome back to Peoria Magazine’s Econ Corner, a recurring feature in which we pose questions to experts about various economic issues and how they affect our lives and careers here in central Illinois.

Doing this month’s Q&A is Dr. Charles Kahn, professor emeritus of finance at the Gies College of Business,University of Illinois Urbana-Champaign. He previously consulted for the Federal Reserve Bank of Chicago (2009–2017) and the Bank of England (2004–2006).

Peoria Magazine (PM): Ultimately, Congress reached an accommodation on raising the debt ceiling and President Biden signed it, but not until taking things down to the wire again. In any case, many Americans don’t seem to take default on the debt seriously, including a former president who recently said, “Well, you might as well do it now, because you’ll do it later.”

Can you discuss the consequences of default, how serious it is, and how everyday Americans would notice the effect on their lives?

Charles Kahn (CK): A real default on United States treasury debt, with the government repudiating any repayment, would be an unmitigated disaster.

To see what is involved, let’s consider an analogy: Think of what would happen in this country if, because of some disruption, people suddenly couldn’t pay for things. The chaos would be enormous as purchases and sales suddenly ceased.

Financial institutions own treasury debt in the form of treasury bills and notes. The key thing to understand is that financial institutions use treasury bills and notes in much the same way that individuals use their bank accounts — as a way of holding funds that they will need available to make payments. A sudden disruption in these institutions’ ability to use these funds would be even more chaotic for individuals and businesses, because all individuals and businesses depend indirectly on a variety of financial institutions to keep their funds and make payments for them.

Now some politicians (and, unfortunately, even some economists) like to take a macho stance and say that the U.S. could weather a default. Some have argued that it needn’t be a “real” default because there could only be a temporary cessation of payments on the treasury debt until the congressional fight was resolved.

But meanwhile, there would still be a disruption in financial institutions’ access to funds while their holdings of U.S. treasury notes are in limbo, and that would still mean that all sorts of payments made through those institutions will be disrupted. Even a suspicion that there might be a disruption in the market for treasury notes could be harmful, as all those institutions scramble for some way to continue to operate.

Would they succeed in finding workarounds? Probably, but do we want to be part of that experiment?

In fact, nearly everybody who is seriously involved in these issues, both those in financial institutions and in government, realize that a default — even a “temporary default” — would be a seriously damaging event.

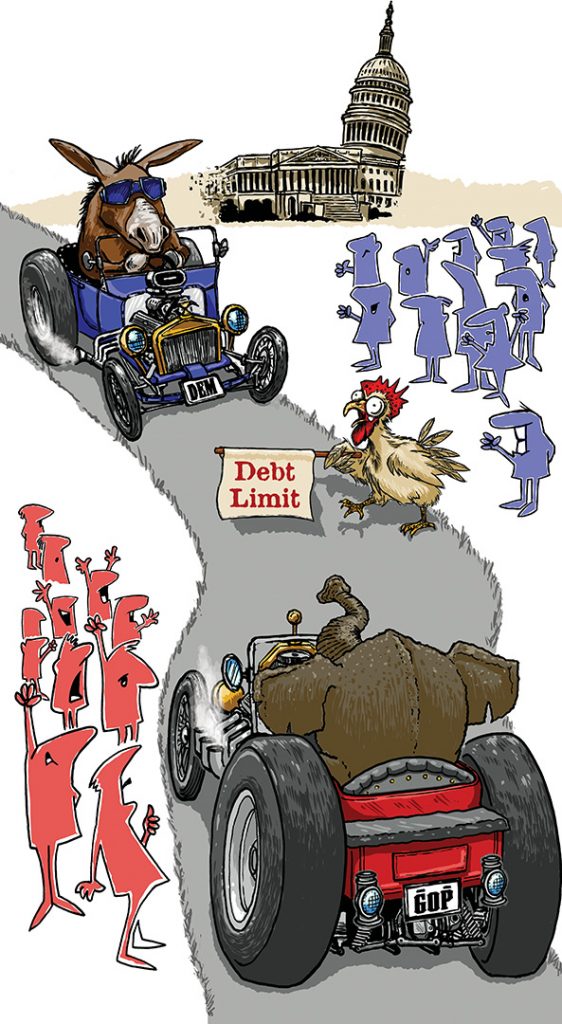

The regular debt ceiling crises are like games of “chicken” between teenage drivers, racing their cars towards each other to show how tough they are, each challenging the other to swerve first. And as in the case of teenage drivers, the real audience is not each other, but the bystanders. It’s a kind of theater.

Moreover, as with teenage drivers, the real risk is that through miscalculation, the politicians don’t swerve in time. At the beginning of the process, the financial institutions are pretty confident that the problem will blow over, and treasury notes and bills will still be usable.

The real concern is that the politicians push the challenge so far that financial institutions have to start taking precautions against treasury markets being tied up, and the precautions themselves start to cause disruption. Were this to happen, the politicians would quickly put on the brakes — blaming each other for the disruption, of course — but the damage might already have been done.

PM: In your view, what is the greater danger to the nation’s economic future — the ongoing spending that has required the raising of the debt limit 78 times since 1960 — 49 times under Republican presidents, 29 times under Democratic presidents — or default?

CK: You ask me to compare the damage from continually increasing government debt and from default.

A lifetime of cigarettes is damaging to your health. Jumping off a cliff is, I suppose, one possible way of stopping yourself from smoking. But if it is successful, it’s because it’s even more damaging to your health!

For all the theatrics involved, there are still real issues in the debt ceiling fight. The debate about the levels of government spending and the right levels of government debt involve serious and substantive questions. Those debates will inevitably lead to political fights with threats and counter-threats between the two sides.

PM: I know you’re an economist, not a lawyer, but do you have an opinion on whether the U.S. Constitution even allows default? There is one school of thought that the 14th Amendment precludes default — “The validity of the public debt of the United States … shall not be questioned” — and that the president, whoever it is of whatever party, owns both the authority and the responsibility to pay it even without congressional approval. Please elaborate.

CK: You ask if default is unconstitutional. I’m not a lawyer and I have no idea. But I’m not sure it matters, because there seem to be plenty of lawyers on each side of the issue. So I can’t imagine the question being resolved quickly enough through the judicial system to make a difference one way or another the next time the fight arises.

The damage will be done long before the Supreme Court decides the question. So, raising the constitutional issue is just one more part of the theatrics.

PM: We go through this political gamesmanship regarding the debt ceiling on a rather routine basis. Other nations around the world don’t seem to have this ongoing drama, or even have a debt limit provision. Is there a potential solution or mechanism out there that would allow us to avoid these constant showdowns and the courting of economic catastrophe? Please elaborate.

CK: The fact that default has recently been the threat is an accident of history embodied in the rules Congress made for establishing and raising a debt ceiling. It would certainly be possible to rewrite those rules so that, for example, increases in government debt no longer need explicit authorization. Then the debt ceiling would no longer be the weapon in the fight.

Politicians might revert, for example, to using budget authorization and government shutdown as the threat. In fact, it’s possible that fights around the debt ceiling became more heated as earlier reforms made it harder to use budget resolutions as the weapon.

If the budget were once again the focus for the spending and debt fights, it would at least have the advantage of making it clearer to the public what the consequences would be if the two sides failed to find a solution.